As you approach the age of Medicare eligibility, it’s crucial to have a solid understanding of how Medicare works and the various options available to you. Medicare is a multifaceted program with multiple parts and coverage options, and a comprehensive understanding is vital for making well-informed decisions about your healthcare coverage.

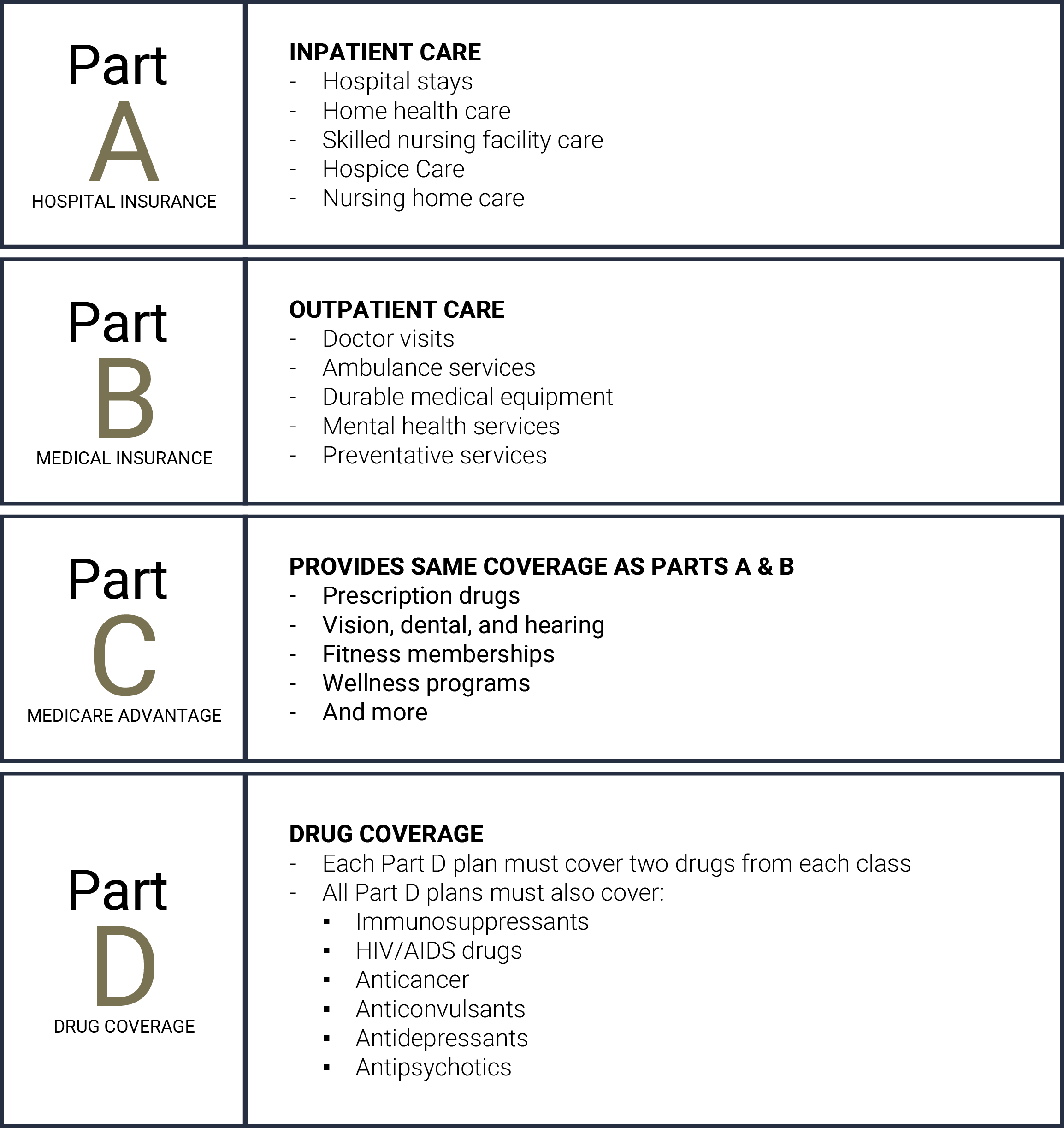

Medicare is a federal health insurance program designed to provide coverage for individuals aged 65 and older, people with specific disabilities, and those with End-Stage Renal Disease (ESRD). To make informed decisions about your healthcare, it’s essential to comprehend the different parts of the Medicare program.

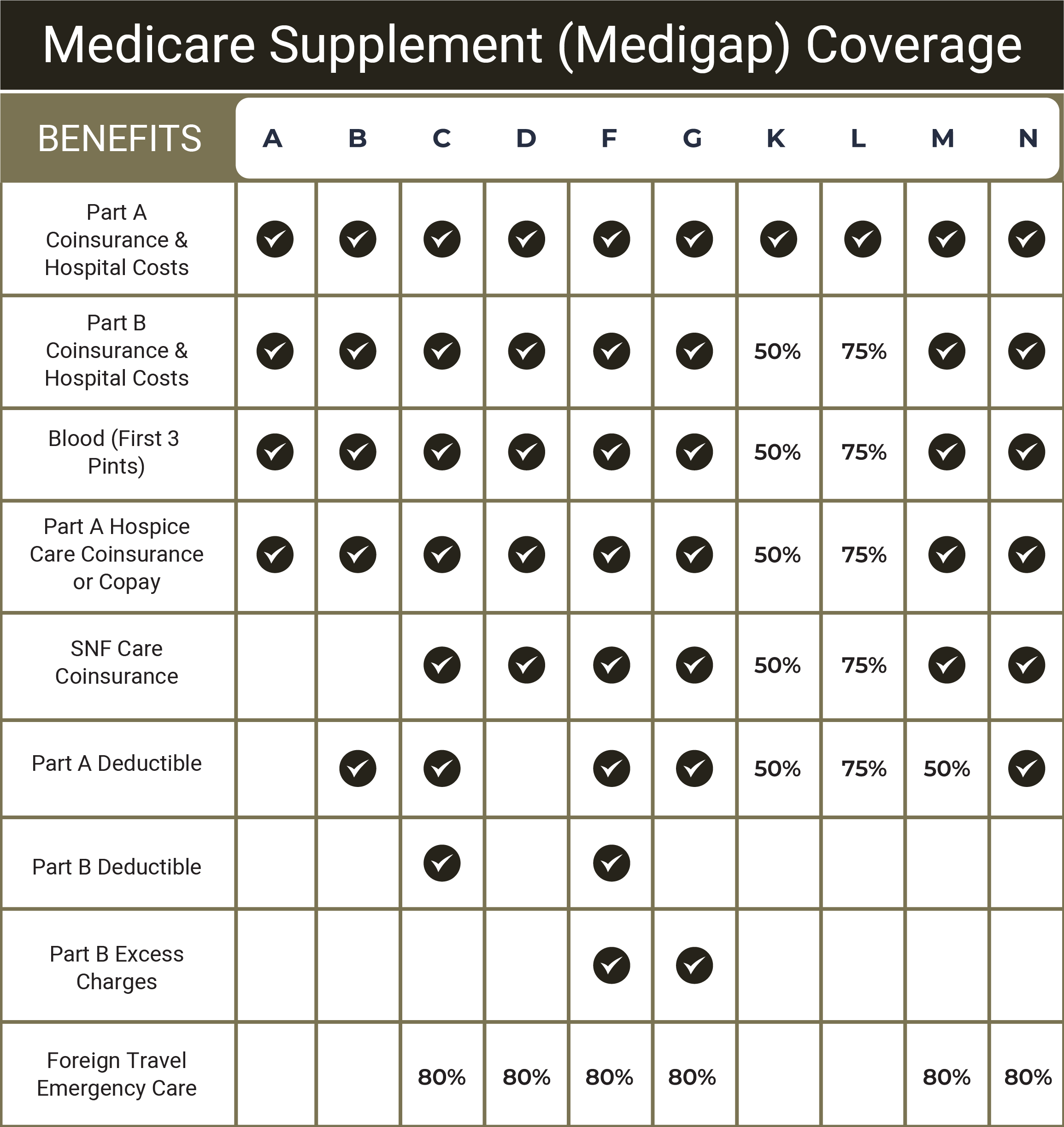

Medicare Supplement plans, commonly referred to as Medigap plans, are crafted to alleviate some of the out-of-pocket costs associated with Original Medicare (Part A and Part B). These plans are offered by private insurance companies and cover expenses such as copayments, coinsurance, and deductibles.

Medicare eligibility depends on various factors. To determine if you qualify for Medicare, you should meet specific criteria based on your age, citizenship, or medical condition. Eligibility varies as follows:

Once you qualify for Medicare, it’s essential to understand the enrollment periods available. Familiarizing yourself with these periods can help you make timely and informed decisions about your healthcare coverage.

Initial Enrollment Period (IEP)

The IEP is a crucial period that begins three months before your 65th birthday and extends for three months afterward. Enrolling during this time is highly recommended to avoid coverage gaps.

General Enrollment Period (GEP)

The GEP runs from January 1 to March 31 each year. It is an opportunity to enroll in Medicare if you missed your IEP. However, enrolling during the GEP may lead to late enrollment penalties.

Special Enrollment Period (SEP)

You may qualify for a SEP, which allows you to delay your Medicare enrollment without incurring late enrollment penalties. This period is available if you’ve experienced specific circumstances that warrant a delayed enrollment.

Medigap Open Enrollment Period

The Medigap Open Enrollment Period spans six months, beginning when you turn 65 and your Part B coverage becomes effective. During this window, you can purchase a Medigap plan without the concern of being denied coverage.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period runs from January 1 to March 31 each year. If you have a Medicare Advantage plan, this is the time to switch to a new plan or return to Original Medicare. You can make this change only once during this period.

Annual Enrollment Period (AEP)

The AEP takes place from October 15 to December 7 each year. During this period, you can review your Medicare plan and make changes if necessary. Any adjustments will become effective on January 1 of the following year.

Medicare is a significant aspect of your healthcare, and making informed decisions about your coverage is of utmost importance. We are here to assist you through the process. If you have questions or need expert guidance regarding Medicare, don’t hesitate to contact us today. Our team is ready to help you navigate the complexities of Medicare and make the right choices for your healthcare needs.

Fill out the form or reach out to us using the information below!

Don’t navigate the complexities of Medicare alone – let Askins Insurance Team be your guide to a brighter and healthier future.

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.